Key ideas in this article:

- Background: Growing competition for value-sustaining infrastructure assets. Strong volatility of the risk landscape. Unprecedented social pressure to act more responsibly. Limitations in human skills to grasp radical complexity.

- Challenge: The infrastructure sector needs to find new ways of identifying and assessing risk, using holistic, innovative approaches that recognize the role of data gaps, group think and bias in decision making.

- Solvere’s approach: Nautinfra - an innovative solution that combines our experience as infrastructure advisors with organizational research and geographical information systems to navigate complexity and detect critical elements in infrastructure portfolios.

Infrastructure finance: Fierce competition for assets

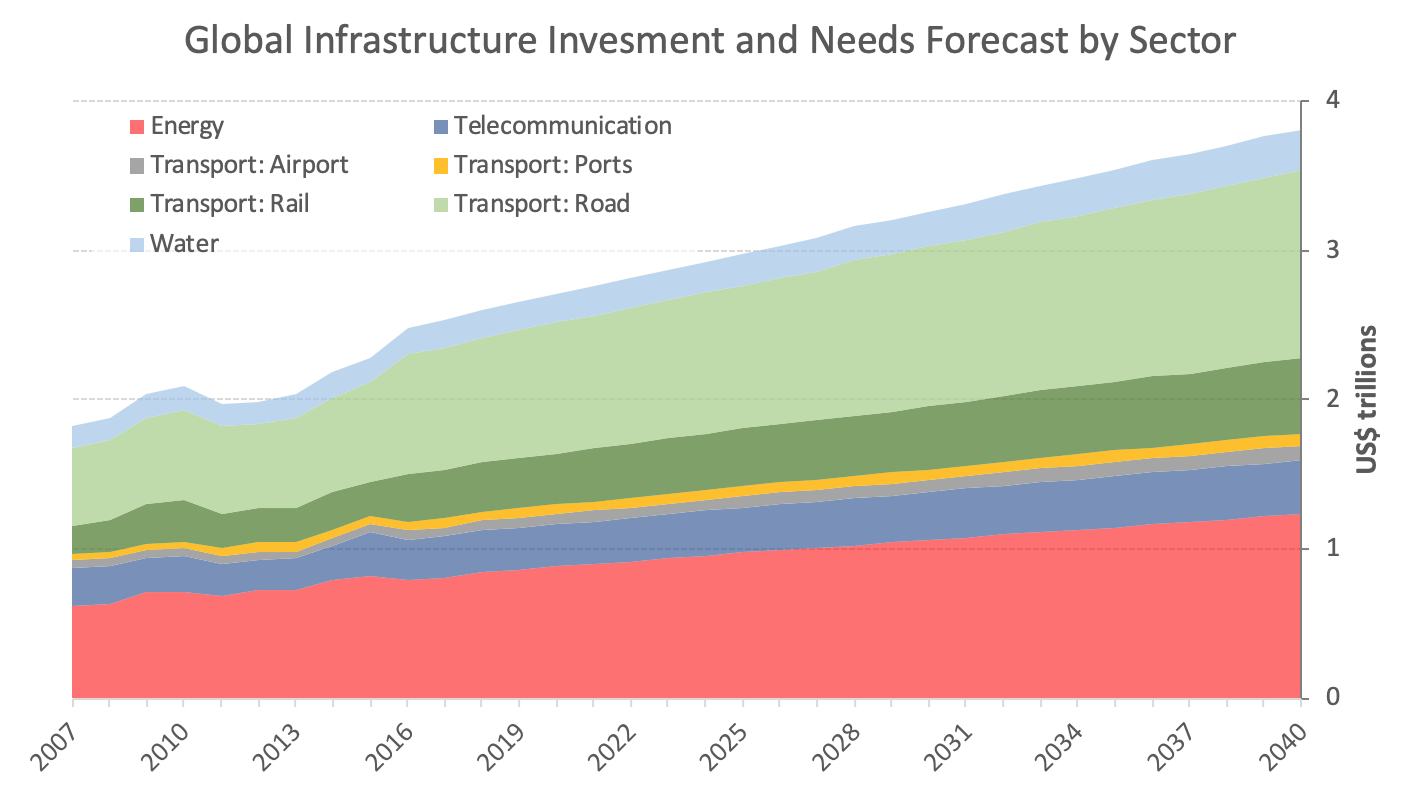

We all agree that we need more and better infrastructure to thrive as a society. We often come across one of the many studies that try to estimate how much infrastructure investment is needed globally to sustain economic development, such as the Global Infrastructure Hub's Infrastructure Outlook. Without entering into the argument about the accuracy of these estimates, there is broad consensus about the considerable effort required globally to deal with all aspects of the financing, delivery and maintenance of infrastructure, both new and existing. For us infrastructure professionals this means a phenomenal opportunity.

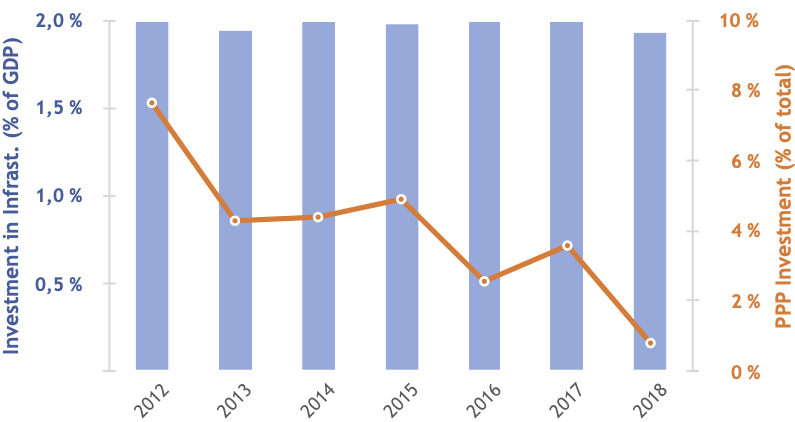

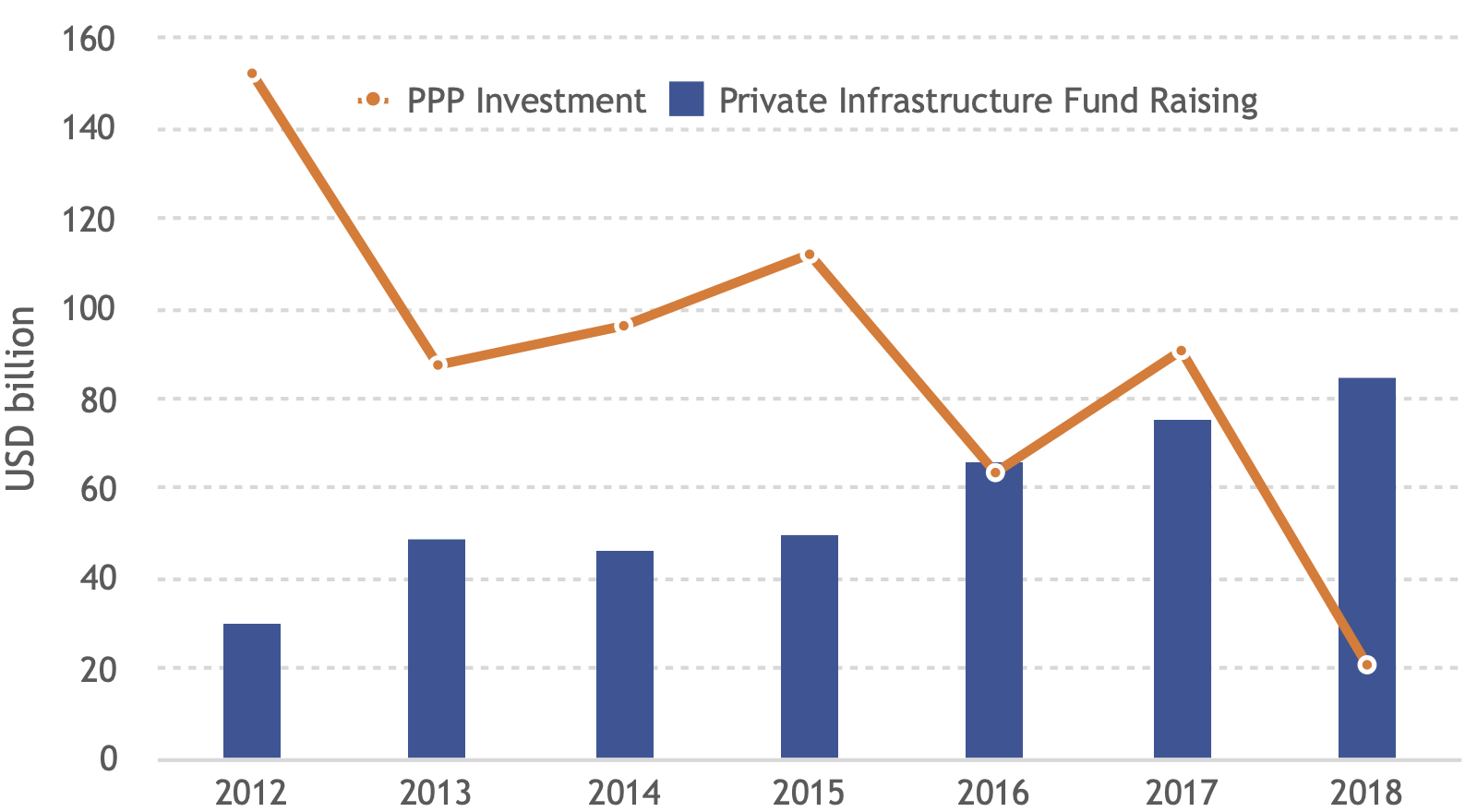

However, the reality is far from ideal, much more complex than what those grand numbers portray. The pictures below show data gathered and published by Solvere's managing partner Jose Cordovilla in his monographic series 'The PPP Crisis' available on Linkedin. Despite much more knowledge, institutional capacity and private capital being available than ever before for infrastructure development, the actual delivery of PPP projects has stalled.

Global infrastructure investment stays stable at approximately 2% of GDP, and because GDP is increasing, infrastructure investment increases, too. Global GDP has grown by approximately 30% since 2012 and government investment in infrastructure has remained at around 2% of GDP per annum, while the proportion of it that goes to PPP investment has plummeted from 8% to less than 1%.

Long-term investment decisions and the volatility of (perceived) risks

Private capital raised for infrastructure investment has increased threefold since 2008, mainly through the so-called "institutional investors" that include pension funds, sovereign funds, endowments, private investment funds and insurance companies. As a result, there is an excess of demand for investable (bankable) projects that meets little supply, which has a direct impact on the valuation of assets, as shown in research conducted by EDHEC Infrastructure.

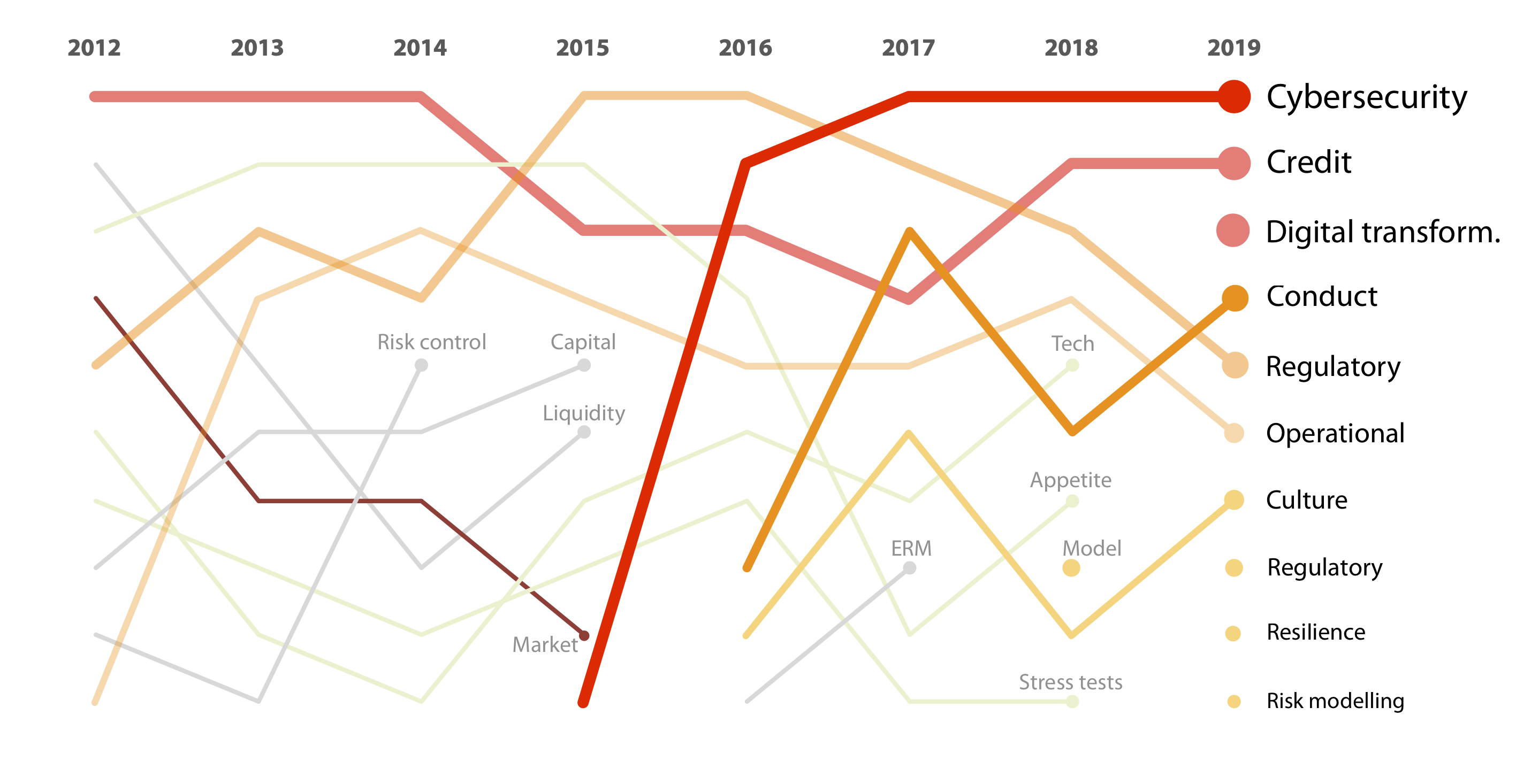

At the same time, we are trying to forecast revenues, costs and risks twenty, even thirty years ahead when actual facts make us question our ability to forecast 5 years ahead. Take a look at the banking sector -which is so relevant to project finance and PPPs: a survey among chief risk officers that EY and IIF carry out every year shows that 7 of the top-10 risks on the 2019 radar of CROs in the banking sector were not there 5 years ago. Furthermore, four of those top10 risks were not on the list 2 years ago. This tells us on one hand that the business environment is changing very fast, but also that risk perceptions change very fast, too.

The ESG phenomenon is here to stay

To make matters more challenging, everybody is trying to do good AND make money at the same time. Corporate social responsibility and reputation management have entered a new era in the infrastructure business -as with other sectors-, and we are witnessing the unstoppable rise of the ESG phenomenon, which is about companies, institutions and individuals doing our work with due consideration of Environmental, Social and Governance matters, including showing everyone how we do it.

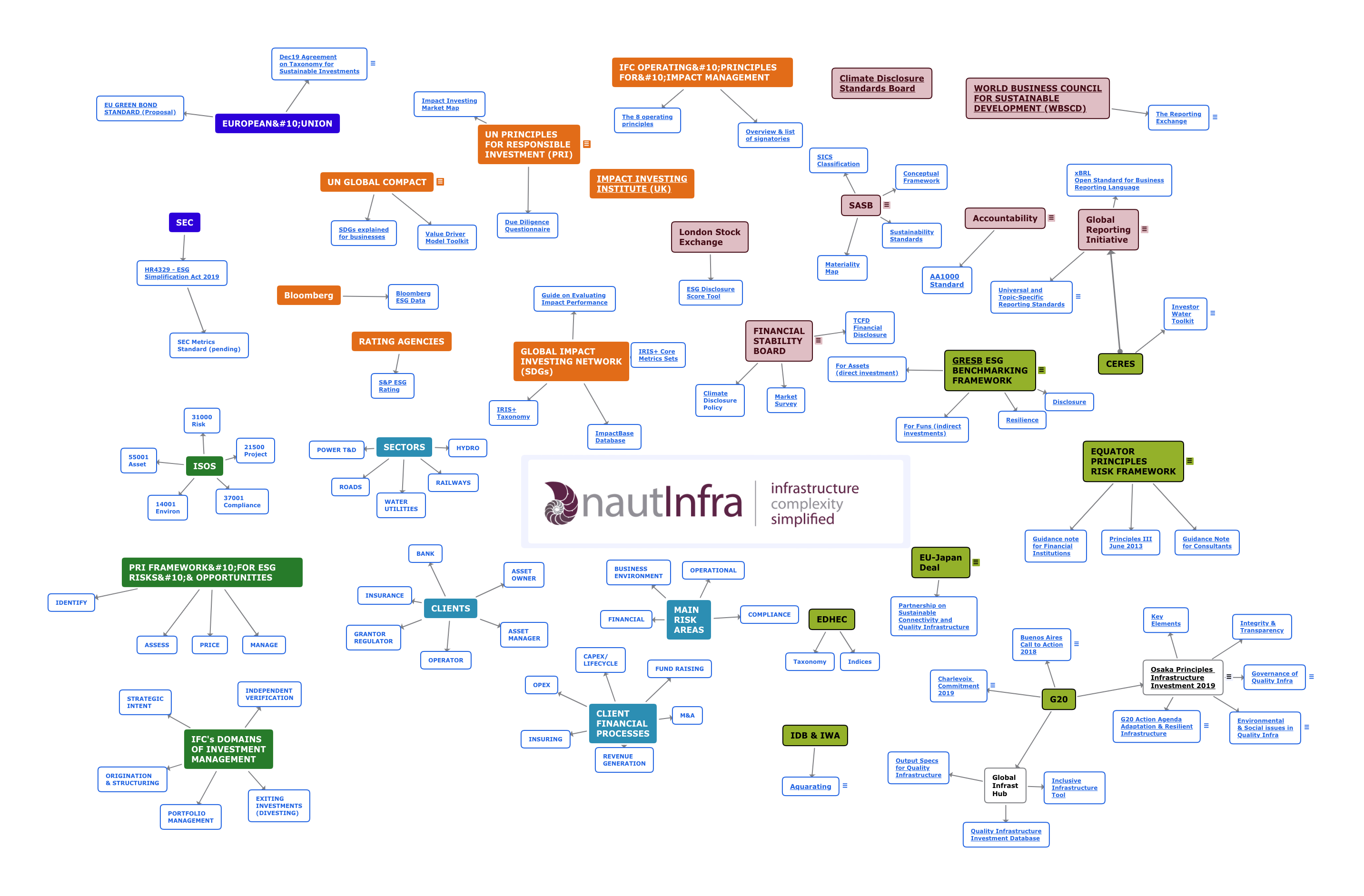

We at Solvere have done research to map the landscape and ecosystem of the ESG phenomenon and have identified over 20 global initiatives -both regulatory and voluntary- that aim to become global standards of ‘doing good’ in the infra business, including the recent EU consensus on the taxonomy of sustainable finance, on which we have commented in a different post. At the core of these initiatives is the will to answer very difficult questions: what is a sustainable business, and what is not? How can we evaluate, measure and compare sustainability in different projects or activities? How should we monitor and report compliance with ESG principles while supporting business?

The digital world is even more prolific, with over 1000 global and regional policy instruments and tools already created for the use of data for sustainable decision-making (Digital Watch Observatory).

Recognizing the complexity of infrastructure systems

Coming back to our field, we are getting used to the idea of infrastructure as a system-of-systems: layers of physical, information and human elements that interact with and depend on one another to provide functions that are essential to communities and society. Economic development and technology are fuelling complexity and uncertainty to extents that are becoming very difficult to grasp, because of the dynamic and non-linear behaviours that are inherent to complex infrastructure systems.

If one puts these systems in the hands of people, who typically make decisions based on incomplete knowledge and their own subjective perceptions and presumptions, it is no wonder that forecasts and plans can be wrong by orders of magnitude, not just percentage points.

One interesting phenomenon in this regard is the paradox of information, which tells us that, because our brains are made for pattern recognition and generalisation, the more information is presented to us, the more likely we are to instinctively opt for over-simplistic explanations to the problems. This built-in feature that has given us a competitive advantage in basic life-threatening situations historically, can turn into a recipe for disaster when confronted with highly complex situations unless contingent measures are in place.

And disasters, unfortunately, do happen

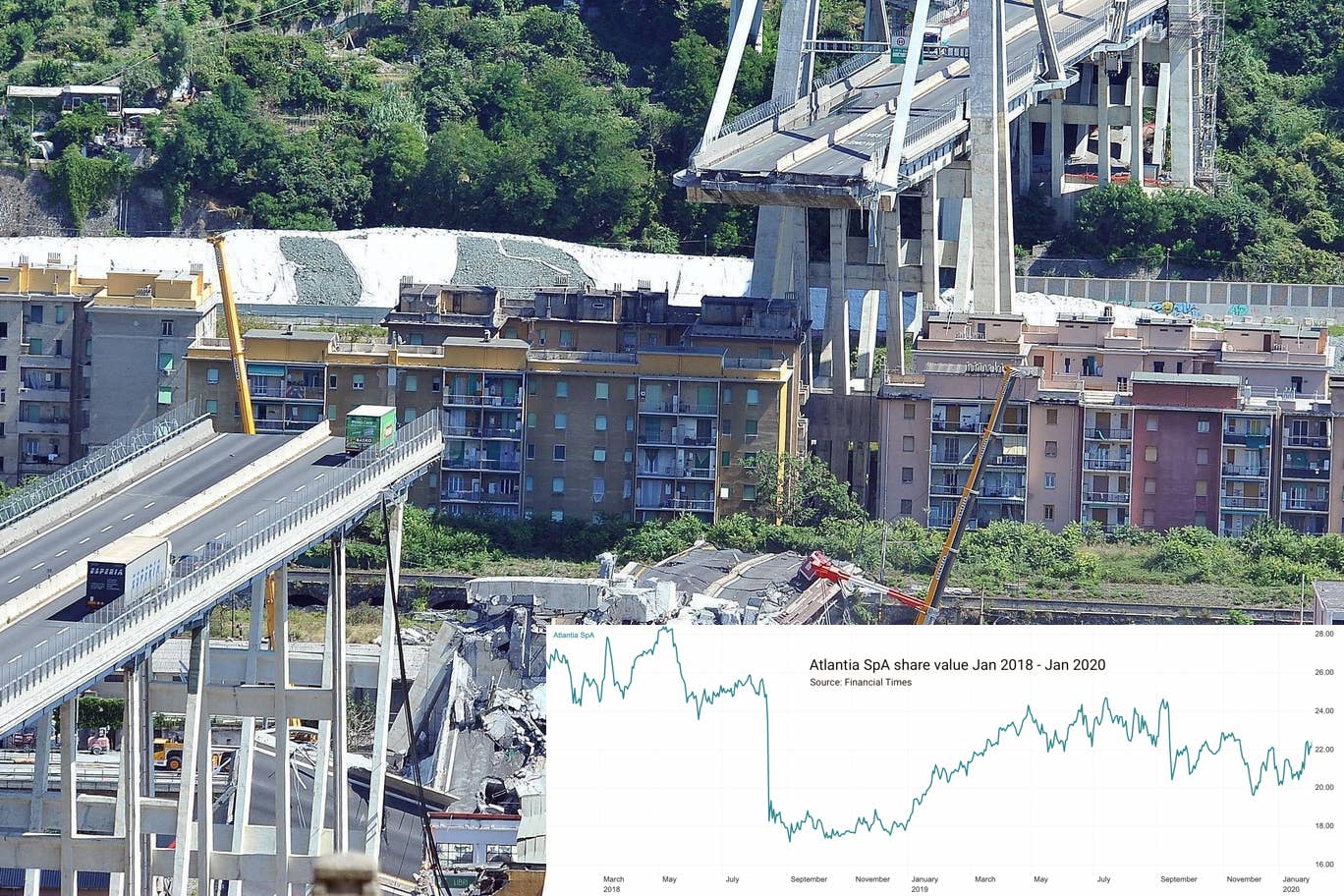

In August 2018, the Polcevera bridge (known as ‘Morandi Bridge’) of the A10 motorway in Genoa (Italy) suddenly collapsed killing 43 people and bringing consequences that keep creeping in one and a half years later. Aside the cost of reconstruction and third-party damages, estimated at EUR 200m and EUR 360m respectively, the company that owns Autostrade per l’Italia (the road operator), Atlantia, has lost 23% of its market value -at some point it lost one-third of it, has seen the resignation of its CEO and is pending a criminal case that could turn fatal for its business. There are also wider -and difficult to estimate- economic and social damages of shutting down a major transportation artery to the north of Italy for years.

The key lesson, however, from this lamentable event is one of organisational failure. Anyone in the government or the operating company would have acted had they known or believed that the collapse could happen. But they didn’t. Everything was in place in the organisations for certain explanations and interpretations to be accepted by everyone, even when the technical criteria recommended otherwise. The people and organisations making the decisions failed, the control mechanisms failed, and the disaster happened.

We have carried out our own research about similar critical infrastructure failures in the past and extracted certain insights:

- they happen both in public and private operators

- although they happen in both advanced and developing countries the former are more frequent, possibly because the assets are older and the systems more complex

- the nature of the triggering event is diverse: man made, natural disasters, accidents..

- there are different modes of propagation of the critical situation, i.e. there is not a single, dominating way in which cascading events happen.

The common theme we have found is that, systematically, human decisions and behaviours are driving the onset of critical events and amplifying the consequences.

Solvere is not alone in these conclusions. In the US -the home of critical infrastructure protection theory and practice since the times of President Bill Clinton- , the Dpt of Transportation and the Dpt of Homeland Security are jointly responsible for overseeing the security, continuity and resilience of the national infrastructure systems. Their latest progress report, published in 2018, gave an overall score of 3.6 over 5 and the interesting thing is: all four goals evaluated scored the weakest in aspects related to organisational capacity, awareness, skills, collaboration and knowledge sharing.

Time for a cultural shift in the sector

The challenges of the risk landscape contrast with a construction sector -which underpins infrastructure development and operation- that is one of the least advanced technologically, and by reliable measurements the least productive of all economic sectors. We conclude that a fundamental shift in skills and culture is needed in our sector if we want to excel in managing complexity and risk effectively and building resilience into our infrastructure systems.

Zurich’s CRO Alison Martin illustrated this challenge on an interview by the Financial Times by saying “for anyone who likes science fiction, there is probably a role in risk management”. She also points out that one of the biggest risks that any organisation faces is groupthink, so they are increasingly focused on how psychological aspects like cognitive bias affects risk perception and decision-making in organisations.

Nautinfra: A solution to address the challenge

At Solvere we believe that we should focus more onto what people and organisations that deal with infrastructure perceive and think, rather than the sophistication of assets and contracts.

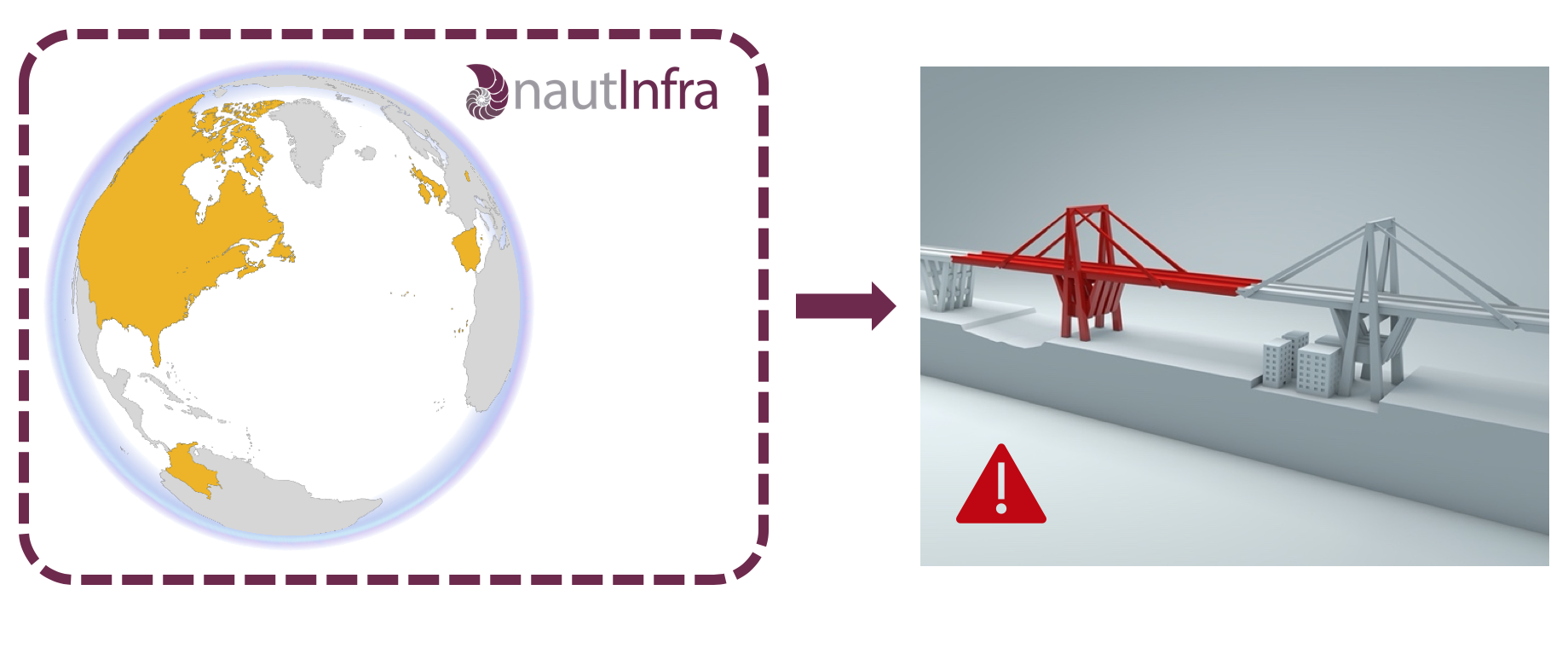

This is why we have developed Nautinfra, an innovative solution that combines our experience as infrastructure advisors with organisational research and geographical information systems to navigate complexity and detect critical elements in infrastructure portfolios. It helps our clients better understand where the limits are in the risk-return binomial and isolate the factors that might trigger critical situations for their businesses.

Abertis -one of the top-5 toll road operators worldwide- has already applied Solvere’s solution to identify and assess the most strategic elements in their network of over 8,000 km of roads across several countries. Nautinfra helps them benchmark all their assets in terms of vulnerability and resilience to prioritise life cycle investments, streamline data processes and extract critical information from their asset management systems.

We help our Clients understand and frame systemic risks, through innovative techniques such as cognitive mapping -in collaboration with University of Manchester Business School- and 2-level iterative screening.

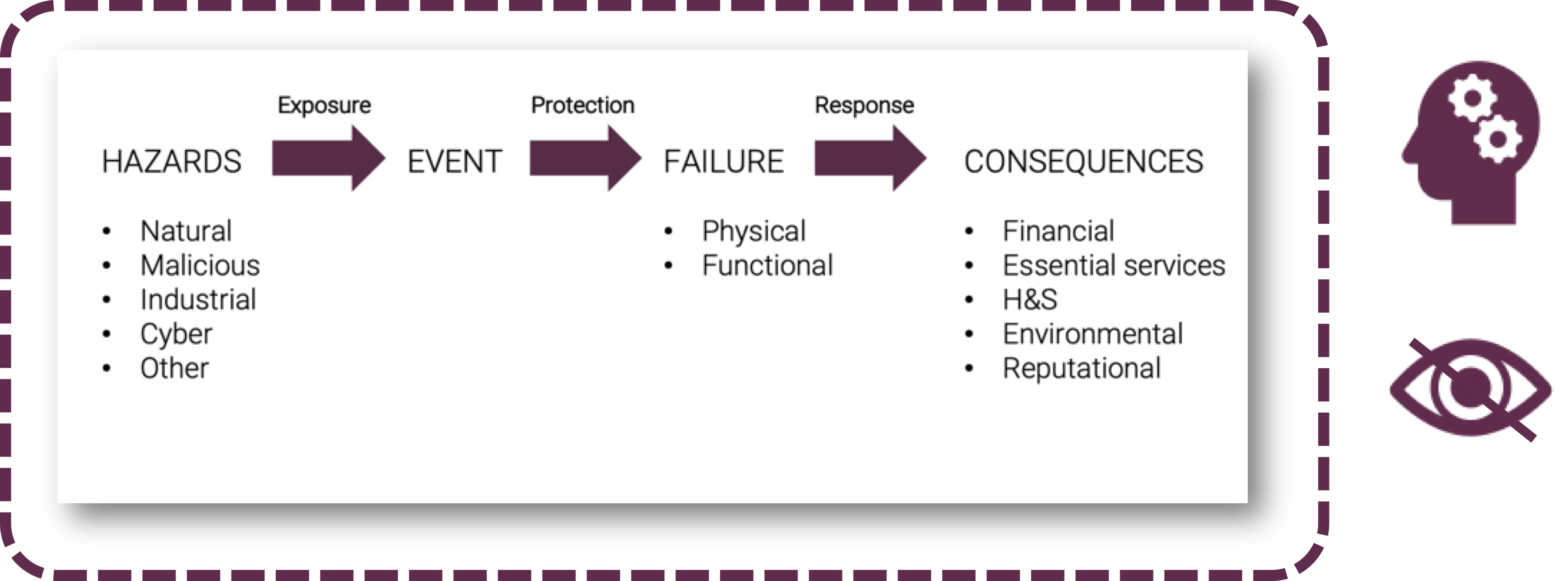

The result of the screening is a concise list of critical factors that include physical assets, processes, people, suppliers and other potential vulnerabilities, along with an "all-hazards" assessment of the consequences that could result if a critical event took place. We evaluate unmitigated and mitigated exposure to financial, environmental and reputational damage, as well as health and safety, wider socioeconomic effects and disruption of essential services as a result of the asset failure.

Our tool includes consistency checks to account for data gaps and bias in the assessment and decision-making processes. The results are collected in a simple, collaborative web portal that includes data analytics, visualization, report management and user collaboration modules. The application is built on open standards that facilitate self-reinforcing collaboration, facilitating sharing and reporting of critical information.

Download our Nautinfra brochure here, or contact us at nautinfra@solvere.es to learn more.

Some of the contents in this article were presented in a webinar we hosted at IPFA on January 30 2020 where we gathered a panel of experts from Abertis, MunichRe, Control Solutions and the Alliance Manchester Business School to discuss some of the latest trends in risk management in complex environments.