The II Global Infrastructure Investor Summit happened. Here are Solvere’s takeaways from the No.1 gathering of private capital for infrastructure worldwide.

Hosted by Infrastructure Investor, the event took place in Berlin on March 19-21 and attracted the majority of the players in the global infrastructure investment industry, which is remarkable for a single event. Our congratulations to the organisers and the speakers and attendees that made it possible.

Solvere sponsored the Global Projects Forum this year, and our team had the privilege of 1) listening to some of the most qualified opinions in the sector; 2) meeting sponsors, investors, developers, lenders and service providers that we can partner with; and 3) providing our own views and thoughts about how to solve the remarkable challenges that the industry faces.

We took away many valuable insights from the forum. Below are the three we have chosen as our favourites.

1. Has infrastructure peaked? We think not. What has peaked is business-as-usual models.

Never mind the amount of people, firms and institutions that were represented in Berlin. No matter how sophisticated our business, corporate, financing and risk management models have become: Private participation in infrastructure is still only a VERY small portion of the total invested, and most of it goes to the familiar geographies.

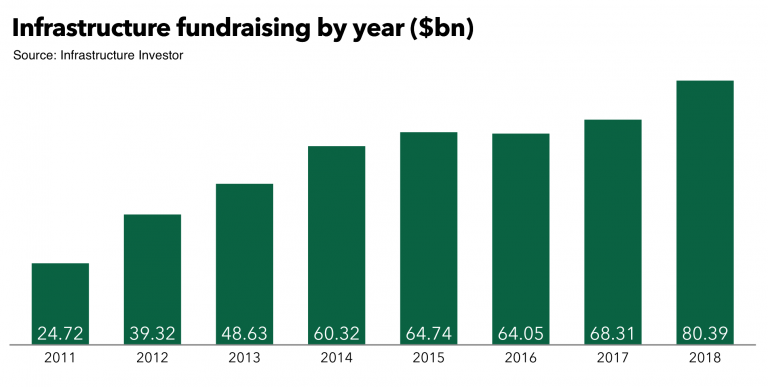

Take the US$ 80 billion raised in infrastructure investment funds in 2018: That makes a tiny portion of the US$2.6 trillion estimated total infrastructure investment across the globe last year. Furthermore, it was said on several occasions during the event that eighty percent of the private investment still goes to core OECD countries.

There was a lot of talk about the “holy grail” of the double-digit returns in infrastructure. When listening to the most experienced people we reasserted ourselves in the conclusion that the double digit is the exception, not the norm for the future of the industry. Infrastructure assets are structurally designed for the long term, and they are very much needed for and linked to economic development. The real challenge is managing stability, be it regulatory, market, technological, or of other nature.

Even when the growth rate of private fundraising for infrastructure might be alarming for many, the industry should stop asking such simplistic questions in a context with so many dimensions. In our opinion, we have only seen a handful of working models in an ecosystem that keeps getting more heterogeneous and dynamic every day. It is business-as-usual that has peaked in infrastructure investment, and there are vast unchartered territories waiting to be developed, much in the same way that Australian and Canadian pension funds pioneered investment in unlisted infrastructure years ago.

2. Growing complexity demands new approaches to business and risk management

One of the things that we really liked about the forum was how openly the panellists and participants were willing to share experiences, concerns, observations and ideas (alright, perhaps not so openly when it came to the disclosure of precise, actual return rates, but that will gradually change). To us, this is proof that changes are happening in the industry as a reaction to the growing complexity of our socioeconomic systems and our limited ability to understand what is going on. We observe a natural, yet counter-intuitive tendency to collaborate, learn and trade-off in the advent of uncertainty.

ESG is a clear example. Environmental, social and governance issues took the centre stage of the discussions during the first day, but also reverberated throughout the rest of the week in Berlin. However, we observed that there is still much confusion about which direction to go, and how to measure orientation and progress. Let us stop for a moment and admit that many of the structures and ideas that have underpinned the infrastructure investment industry so far are unfit for the ESG challenge. As a matter of fact, they were designed to avoid these issues, not to deal with them.

Our opinion is that what is missing is a systematic approach to dealing with complexity. A system-of-systems approach is in order to avoid falling into the trap of control illusion: building more and more sophisticated tools and arrangements to control every single corner of the analytical framework, overlooking not-so-obvious behaviours that really drive infrastructure in the long run. Systems thinking calls for moving from looking out for risks to looking inward for capacities, skills, interdependencies, vulnerabilities, biases. Resilience requires moving the focus away from artificial legal and market architectures and onto built-in functions and flows of our systems.

3. Technology? Yes, but the real revolution is cultural.

Some voices at the forum were sceptical about the disruptive capacity of technology to transform the industry. We concede that technology can only go so far, especially when the people using it cannot comprehend its potential and limitations. The big point here is that the real revolution is the generational, cultural change that will transform the way that infrastructure is financed, delivered and operated. This is already seen in the business models at work in the software sector, and we should pay close attention to the talent, views and drivers of the young people entering our sector; they don’t see technology, ESG, sustainability, gender equality, or collaboration as aspirational goals. They are part of their culture already.

Now, this revolution may not necessarily happen in a spontaneous, revealing, flash-like fashion. It may well be a subtle one. Perhaps one key cultural aspect to change is the obsession in the sector with the next new best thing. If we are talking infrastructure, we are in the realm of long-term planning. How about stopping to look for the next thing that will bring double-digit returns in the short-to-medium term and focus on what has brought stable returns in the long term?

To face rapid change and unpredictability, and without getting too philosophical about it, we at Solvere like to rest on a fundamental principle: complex systems that endure evolved from simpler systems that work. For those of you fans of systems thinking, this is called Gall’s law. So, let us observe the simple infrastructure investment systems that have worked, study the characteristics of the people and organisations that made them work, and take them to the next level by combining with other systems that also worked, no matter how far outside our zone of comfort the latter are. In this analysis we will probably find many experienced professionals who were bold enough to listen to and rely on young talent.

We will keep sharing our views on the fascinating things happening in our sector. Stay posted.