The EU is advancing clearer language for green finance—this is a sign of positive engagement and leadership. Here is Solvere's analysis of what the taxonomy is and what it means for our sector:

The taxonomy

- brings clarity and consensus on what can legitimately be labelled “green”

- helps investors and companies understand how to create credible impact, and how to report about relevant sustainability matters

- helps governments more accurately diagnose and create robust economic policies

- gives regulators capacity to monitor and act to balance the needs of the private sector and citizens with the environment

Positive or negative?

The taxonomy brings harmonisation across the region with regard to the language and criteria for raising funds for sustainable projects. A common framework for labelling investments and reporting on their sustainable or unsustainable qualities leaves less room for ambiguity or suspicion and incentivises analytical rigour, therefore reducing risk. This should lead to greater mobilisation of private capital towards the funding of activities that actually are environmentally sustainable.

The labelling gives the public financial institutions and regulators such as the EIB European Investment Bank or the European Central Bank clarity to execute and measure policy outputs. The EIB, for instance, is a fundamental force in infrastructure development in Europe: the co-financing and syndication of infrastructure should have positive effects—if the implementing guides are properly defined.

However, we should be very cautious about expectations and rigorous about the development of the detailed rules and monitoring mechanisms in the coming months.

First, any ‘labelling’ exercise can turn barren if transparency rules and data standards are not in place. Sustainability is an extremely complex matter and still incipient in the geopolitical and financial fields, so we can -and should- expect the initial criteria to have gaps and mismatches, substantial even. The oil to grease the feedback machine so that the taxonomy is continuously improved, as expeditiously as possible, is transparency. The better the data and means of exchange, the more effective and durable the criteria will become.

Second, we should not forget that the new regulation directly addresses environmental aspects, but not social and governance aspects (which make up the “S” and the “G” in ESG). These two aspects are left to the generalities of global standards such as the OECD’s, which are not exempt of challenges themselves. So there is still work to do on that front.

Third, although a regulatory taxonomy is very important, it is in the day-to-day activity of sustainable finance -mostly private sector- where the actual successes or failures will take place. Collaboration with the private sector -including the setting up of explicit policies and instruments to encourage it- is of the essence from day one.

Detailed analysis — what is it?

This so-called ‘EU Taxonomy for green investments’ is a regulation approved by the European Parliament and the EU Council in December that establishes the criteria for determining whether an economic activity (for example a manufacturing company) and any investment products associated to it (for example shares of corporate bonds) can be classified as environmentally sustainable. Prior to this regulation there was no harmonised standard in Europe to classify green investments.

It directly affects all regulations in the EU and its Member States that relate to the requirements on financial markets for products designated as environmentally sustainable, including the recent EU Regulation 2019/2088 on sustainability‐related disclosures in the financial services sector.

The regulation is far from final. Instead, it is a general framework laying out the guiding principles to elaborate the detailed technical criteria during the next two years. The complete screening criteria must be ready before 31st December 2021 and will come into force one year later.

Under this taxonomy, an economic activity must fulfill all of the following conditions to qualify as ‘sustainable’:

- Substantially contribute to at least one of the six environmental objectives defined, namely: (i) climate change mitigation; (ii) climate change adaptation; (iii) sustainable use and protection of water and marine resources; (iv) transition to a circular economy; (v) pollution prevention and control; or (vi) protection and restoration of biodiversity and ecosystems.

- Cause “No significant harm” to any of the other environmental objectives;

- Comply with robust and science-based technical screening criteria; and,

- Comply with minimum social and governance safeguards.

The regulation defines what “substantial contribution”, “no significant harm” and “minimum social and governance standards” mean, but not the screening criteria -as mentioned above- nor the mechanisms to verify and monitor the compliance with the criteria.

Who is it for?

It applies to any financial products or corporate bonds that are made available as environmentally sustainable, any financial services companies subject to the obligation to publish non-financial statements, as well as any policies or regulations in the EU and Member States that may be related. In practice, we are talking about the whole financial sector -banks, investment companies, pension funds, insurance companies, etc. and the large companies and assets connected to the financial products they trade with: bonds, debt, securities, investment vehicles, etc.

Benefits

The new EU green investment label becomes the most important standard to date for investors and financial markets worldwide, reaffirming the EU leadership in the global effort to achieve carbon neutrality and sustainability. Clear definitions and rules are a fundamental pillar of the immense collective action that is required to achieve the vision to make Europe carbon neutral by 2050.

The taxonomy actually does bring harmonisation across the region with regards to raising funds for sustainable projects. In theory, both governments and the private sector should find it easier to raise funding for their environmentally sustainable activities in their countries AND across borders, since any economic activities or assets can be compared using a common language to describe how related investments contribute to environmental sustainability. This should, in turn, facilitate the flow of investments and economic activity across the EU.

The regulation is also a tipping point for the reporting and disclosure obligations of European companies and financial markets. Greater transparency about the environmental impact of all sorts of economic activities means investors will have much clearer and homogeneous information about the sustainable qualities of the assets they invest in, reducing the risk perceived and lifting much of the burden to check, compare and aggregate different financial products. On the other hand, the requirement for financial products and services to disclose how and to what extent their underlying activities are environmentally sustainable should spur more rigour, responsibility and diligence in the allocation of resources. This dynamic should steer financial markets towards actually meeting their social and economic purposes.

The Commission Executive Vice-President Valdis Dombrovskis ventured to state that “… this piece of legislation will be a game-changer in terms of tackling climate change, because it will enable billions in green investments to flow”.

One should remain very skeptical about such grand statements. There are many things that could go wrong along the way.

Challenges and risks

A taxonomy is a sort of vocabulary plus classification criteria for families of things, in this case investments, and in this case to label them as either sustainable or not sustainable. The fact that a taxonomy has been defined does not mean that investments will actually be sustainable within a small margin of error, unless it has been thoroughly verified, or rigorous contingencies have been put in place to adjust the criteria in case things go wrong. First of all, there are reasons to believe that the margin of error is quite wide in the field of estimating the degree of sustainability of an activity or project. Research conducted by the MIT Sloan School of Management shows ESG scores from different rating agencies are aligned only in about 60% of the cases. The Economist newspaper has also looked into the issue recently, concluding that, unlike credit ratings, ESG scores are poorly correlated with each other, so rating firms disagree about which companies are good or bad.

Therefore, the task of defining the detailed evaluation criteria during the next 24 months is crucial.

Another reservation to hold is the fact that the regulation leaves the social and governance aspects of investments to the generalities of global standards such as the United Nations-supported Principles for Responsible Investment (PRI). The rise of inequality in many advanced economies points to considerable shortcomings either in the standard, or in its application, or both.

But there is an even more fundamental problem of data. What data is available to test and validate the criteria, and furthermore to evaluate a wide range of economic activities and assets against these criteria? The sad answer is: very few. Without an information strategy and adequate data exchange standards, both for the investments themselves and for the governance mechanisms (public and private) there is a great risk that the standardisation exercise might become a technocratic nightmare, or a massive greenwashing machine, or both.

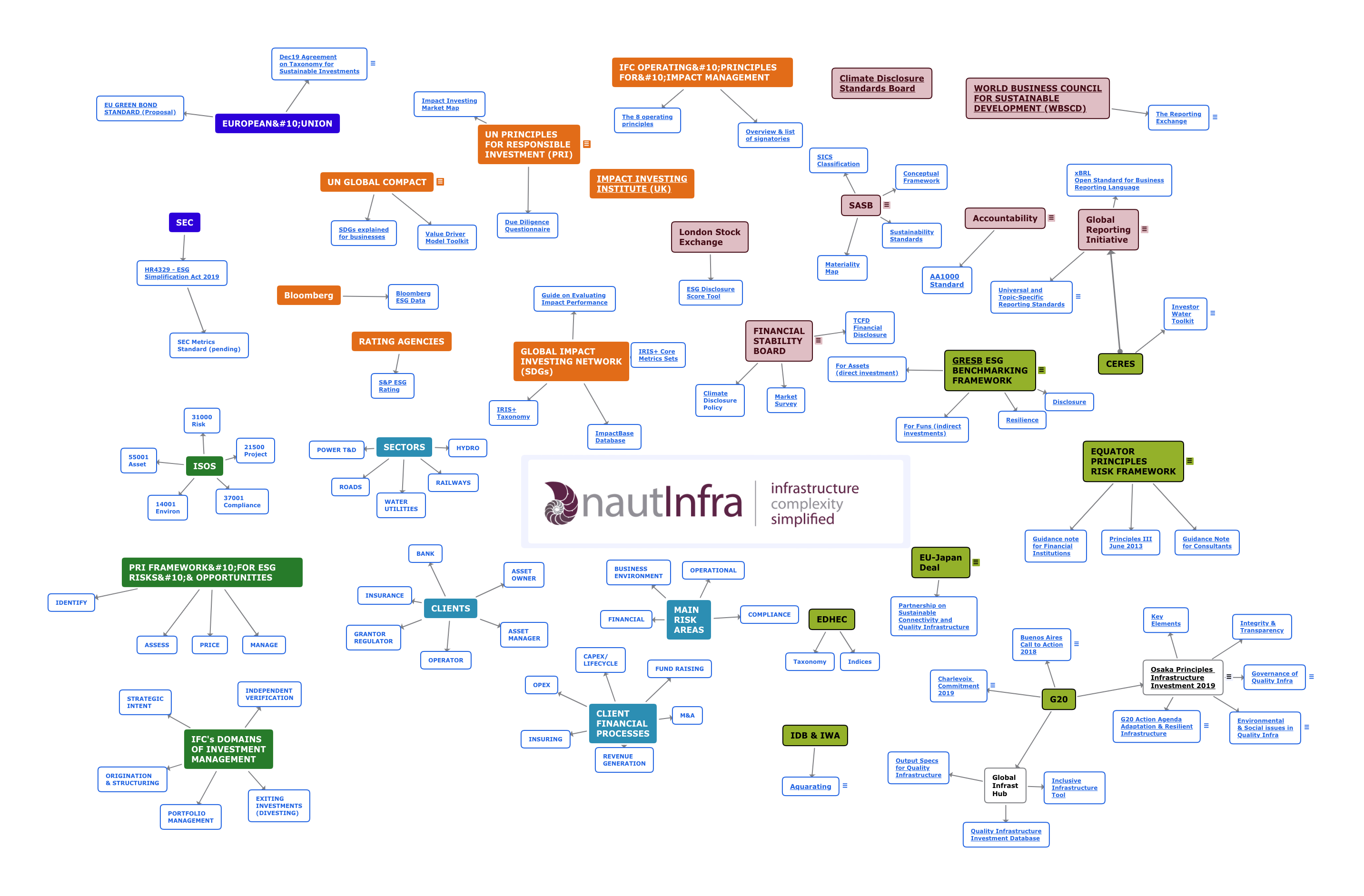

We see this already happening in the private sector globally, where standards and metrics for sustainability issues have mushroomed in the past two years: GRI, PRI, IRIS taxonomy, IFC principles, TCFD policies, WBSCD, SASB, assessment methodologies by rating agencies and “big four” accounting groups, etc. (see references below). We are currently nearing a tower-of-babel situation, with companies yearning for harmonised metrics for the UN goals “so we don’t have to argue with everybody”. This has led both the private sector and public authorities to seek consensus.

The new EU taxonomy is, to great extent, a consequence of this gap. Europe has had the boldness to take the first step and lead the global movement. The US is following, and congress has recently asked the Securities Exchange Commission (SEC) to develop detailed criteria and metrics for ESG disclosure and establish a Sustainable Finance Advisory Committee.

The EU Taxonomy is a noteworthy milestone that sets a common language for collaboration in sustainable finance. We are at a crucial time now to make this language work for collective action, and this needs us to focus on the detailed criteria and governance mechanisms that will unlock the much-needed resources.

Links/References

- Official Press Release on the approval of the Regulation, with statement from the Commission Executive Vice-President Valdis Dombrovskis

- Full text of the Regulation as approved by the EU Parliament and EU Council

- EU Regulation 2019/2088 on Sustainability‐related Disclosures in the Financial Services Sector

- European Investment Bank – Green Bonds

- Berg, Florian and Kölbel, Julian and Rigobon, Roberto, Aggregate Confusion: The Divergence of ESG Ratings (August 17, 2019). MIT Sloan Research Paper No. 5822-19. Available at SSRN: https://ssrn.com/abstract=3438533 or http://dx.doi.org/10.2139/ssrn.3438533

- The Economist, December 7th 2019 Edition. Poor scores – Climate change has made ESG a force in investing

- Global Reporting Initiative – Standards

- Sustainability Standards Accounting Board (SASB) – Standards

- World Business Council for Sustainable Development (WBCSD) – Reporting Exchange

- Task Force for Climate Change Financial Disclosure (TCFD) – Recommendations

- UN Principles for Responsible Investment

- Global Impact Investing Network – IRIS Taxonomy

- S&P Ratings – ESG Rating Methodology

- US House of Representatives Bill requesting the SEC to developed detailed ESG criteria and metrics

This post was originally published on the blog of IcebreakerOne, where Solvere is a founding member and collaborator.